The post New Rules for EV Tax Credit Make Most Vehicles Ineligible first appeared on Joggingvideo.com.

]]>This story is part of CNET Zero, a series that chronicles the impact of climate change and explores what’s being done about the problem.

The US Treasury Department has issued new guidance for the EV tax credit that will seriously curtail how many vehicles now qualify for the tax break, worth up to $7,500.

The credit was revamped by the Inflation Reduction Act of 2022, which added income caps, price limits and other stipulations. Most changes took effect in January, but final details about battery components and “critical minerals” were still being nailed down when President Joe Biden signed the bill in August.On March 31, the Treasury Department announced that 50% of a vehicle’s battery must be assembled or manufactured in the US for it to qualify for up to $3,750 of the credit. That percentage ratchets up each year until it hits 100% in 2029.

For a vehicle to qualify for the other $3,750 of the credit, 40% of the critical minerals in its battery — like graphite, lithium and cobalt — must be sourced from the US or one of the 20 countries the US has a free trade agreement with. That amount will increase until 2027, when it maxes out at 80%.

Chinese companies currently manufacture 56% of the EV batteries in the market. That puts the US at a competitive disadvantage and, according to the Biden administration, fuels geopolitical instability.”The adoption of clean vehicles is central to reducing emissions in transportation while protecting Americans from the kind of spikes in gas prices that we saw at the outset of [Russian President Vladimir] Putin’s brutalization of Ukraine,” Lily Batchelder, the Treasury’s assistant secretary for tax policy, told reporters on March 23. “However, we can’t trade dependence on foreign oil for dependence on foreign batteries, and our forthcoming guidance will strengthen our supply chains.”

Starting next year, vehicles that contain battery parts from “a foreign entity of concern” — a classification that includes China, Russia, Iran and North Korea — will be unable to claim any of the credit. For critical minerals, the cutoff is 2025.

The new guidelines take effect on April 18, 2023, when the current tax season ends. The Treasury Department has yet to provide an updated list of approved EVs, but GM said Friday that at least three of its cars — the Cadillac Lyriq and the new Chevrolet Equinox EV SUV and Blazer EV SUV — already qualify for the full $7,500 credit.

Find the right car for you

View Local Inventory

Still, the auto industry has warned that only a fraction of the 91 electric vehicles on the US market today qualify for the full credit, and many won’t be eligible for any tax break at all.

“This latest turn will further reduce the number of eligible EVs,” John Bozzella, CEO of the trade organization Alliance of Automotive Innovation, wrote in a blog post on Friday. “In fact, this period may go down as the highwater mark for EV tax credit eligibility since the IRA passed last year.”

West Virginia Sen. Joe Manchin had pushed for the strict sourcing rules, even going so far as to threaten legislation to block the credit without them. Automakers and car dealers “have to understand that is an energy security bill,” Manchin, a Democrat, said in January, Roll Call reported. “It was never designed to be just a climate bill, which is the way it’s being promoted.”

Kelley Blue Book Executive Editor Brian Moody said the new guidance may temporarily limit how many models are approved, but “at the core, the intentions are in the right place.”

“The policy is designed to get more EVs — and the things that power them — made in America,” Moody told CNET. “With more jobs for Americans and fewer for our adversaries.”Foreign carmakers have anticipated the move, he added, and are broadening their US operations.

“It’s already happening,” Moody told CNET. “Hyundai is building a $5.5 billion plant near Savannah, Georgia, that will include both an assembly plant and a battery factory.”

Expected to produce 300,000 Hyundai, Genesis and Kia EVs a year starting in 2025, Metaplant America will be the largest economic development project in Georgia’s history and a critical part of America’s supply chain for batteries and other EV components.

The post New Rules for EV Tax Credit Make Most Vehicles Ineligible first appeared on Joggingvideo.com.

]]>The post EV Tax Credit: Which Models Will Qualify for the $7,500 Tax Break After April 18? first appeared on Joggingvideo.com.

]]>This story is part of CNET Zero, a series that chronicles the impact of climate change and explores what’s being done about the problem.

The US Treasury Department has announced new guidance on the electric vehicle tax creditWorth $7,500, the tax break was overhauled by the Inflation Reduction Act of 2022. Among other additions, the law established income limits and price caps and required that a vehicle’s final assembly be in the US.

Most of the guidelines have gone into effect already, but final battery and mineral standards were delayed while the Treasury Department hashed out how it would define processing, extraction and recycling.

That guidance is out now and will take effect on April 18. For a vehicle to qualify for the full $7,500 credit next month, 50% of the value of its battery components must be manufactured or assembled in North America and 40% of its critical minerals must be sourced in the US or in a trade-partner country.

The Treasury Department won’t release the list of EVs that meet these standards until April 17, adding more complexity to an already confusing process. Here’s what you need to know if you’re claiming the EV credit for tax year 2022, buying an electric vehicle now or just thinking about it for the future.

For more on electric vehicles, get the lowdown on the best models for 2023, and see how many public charging stations there are in your state.

What is the electric vehicle tax credit?

To encourage Americans to move away from gas-powered automobiles, the federal government allows taxpayers who buy a qualified plug-in, hybrid or fuel-cell vehicle to claim a credit on their tax return, under IRS Code Section 30D.

Find the right car for you

View Local Inventory

Known as the EV tax credit or the clean vehicle credit, it’s equal to $2,917 for a vehicle with a battery capacity of at least 5 kilowatt hours (kWh), plus $417 for each kWh of capacity over 5 kWh, with a maximum of $7,500.

The credit is nonrefundable, so you can’t get back more money than you owe in taxes.

Which cars qualify for the EV credit in tax year 2022?

To qualify for the credit on your 2022 tax return, your vehicle must have been purchased before Jan. 1, 2023, be for your own use and be driven primarily in the US. The vehicle also must have an external charging source and a gross vehicle weight rating of under 14,000 pounds. If you purchased the vehicle last year, it must also have been produced by a manufacturer that hasn’t sold more than 200,000 EVs in the US. In practice, that makes 2022 models from Tesla and Ford ineligible, though this stipulation has been lifted for 2023. In addition, if you bought your EV between Aug. 17 and Dec. 31, 2022, it must have undergone final assembly in North America.

According to the IRS, you don’t have to worry about the final assembly requirement if you “entered into a written binding contract” after Dec. 31, 2021, but before August 17, 2022. (It’s a good idea to check with the IRS or your tax preparer to be certain, though.)

Below is the list of approved 2022 car models from the Department of Energy’s Alternative Fuels Data Center website. (You can also enter your automobile’s vehicle identification number, or VIN, on the Department of Energy website.) As noted, some manufacturers have reached the maximum number of EVs they could sell and still be eligible for the full credit.

Approved 2022 vehicles

| Vehicle | Manufacturer Sales Cap |

|---|---|

| Audi Q5 | |

| BMW 330e | |

| BMW X5 xDrive45e (PHEV) | |

| Chevrolet Bolt EUV | Manufacturer sales cap met |

| Chevrolet Bolt EV | Manufacturer sales cap met |

| Chrysler Pacifica PHEV | |

| Ford E-Transit | |

| Ford Escape PHEV | |

| Ford F-150 Lightning | |

| Ford Mustang MACH E | |

| GMC Hummer EV Pickup | Manufacturer sales cap met |

| GMC Hummer EV SUV | Manufacturer sales cap met |

| Jeep Grand Cherokee 4xe | |

| Jeep Wrangler 4xe | |

| Lincoln Aviator PHEV | |

| Lincoln Corsair PHEV | |

| Lucid Air | |

| Nissan Leaf | |

| Rivian EDV | |

| Rivian R1S | |

| Rivian R1T | |

| Tesla Model 3 | Manufacturer sales cap met |

| Tesla Model S | Manufacturer sales cap met |

| Tesla Model X | Manufacturer sales cap met |

| Tesla Model Y | Manufacturer sales cap met |

| Volvo S60 Recharge |

How do I claim the clean vehicle credit on my taxes?

To claim the credit for an EV you took possession of in 2022, file IRS Form 8936 with your 2022 tax return. (You will need to provide the VIN for your vehicle.)

What if I bought an EV before 2022 but didn’t claim the credit?

If you missed claiming the credit for an electric vehicle purchased before 2022, you may be able to claim it by filing an amended return for the tax year when you took possession of it.

Related stories

- Home EV Charging 101: Levels of Charging Explained

- 7-Eleven Launches 7Charge Electric Vehicle Charging Network

- You Can Now Get a Bank Loan to Finance Your Home EV Charger

What are the changes to the EV tax credit for 2023?

The Inflation Reduction Act made several major changes to the tax credit, including extending it for nine more years, to 2032, and making certain used EVs eligible. Other updates also took effect on Jan. 1, 2023:

- The manufacturing cap, which disqualified automakers that have manufactured more than 200,000 EVs, has been lifted.

- There is a price cap on qualifying EVs. For passenger cars, the manufacturer’s suggested retail price, or MSRP, must be $55,000 or less. For vans, SUVs and light trucks, the ceiling is $80,000. (The MSRP does not include taxes and other fees.)

- Starting in 2024, the credit can be implemented at the point of sale as “cash on the hood,” meaning you can apply it toward the purchase price of your vehicle.

Income cap for EV tax credit

| Filing status | Income |

|---|---|

| Single | $150,000 |

| Head of household | $225,000 |

| Married, filing jointly | $300,000 |

| Married, filing separately | $150,000 |

There is also a ceiling on the adjusted gross income to qualify for the credit.

For the most part, these changes took effect on Jan. 1, 2023, and will remain in effect until Jan. 1, 2032. Always check the IRS website for updates.

EVs that are eligible for the tax credit from January to April 2023

Car buyers are in a bit of limbo right now, with income caps and price limits for eligible EVs already in place but details on which models meet battery and mineral requirements still to be determined. If you bought or will buy an EV between Jan. 1 and April 17, 2023, the IRS says that these makes and models qualify for the credit.

All-electric vehicles

| 2023 | BMW 330e |

|---|---|

| 2023 | BMW X5 xDrive45e (PHEV) |

| 2023 | Cadillac Lyriq |

| 2023 | Chevrolet Bolt EV |

| 2023 | Ford E-Transit |

| 2023 | Jeep Grand Cherokee 4xe |

| 2023 | Jeep Wrangler 4xe |

| 2023 | Lincoln Aviator PHEV |

| 2023 | Lincoln Corsair Grand Touring |

| 2023 | Mercedes EQS SUV |

| 2023 | Nissan Leaf |

| 2023 | Rivian R1S |

| 2023 | Rivian R1T |

| 2023 | Tesla Model 3 |

| 2023 | Tesla Model S |

| 2023 | Tesla Model X |

| 2023 | Tesla Model Y |

| 2023 | Volkswagen ID.4 |

Plug-in hybrids

| 2023 | Audi Q5 TFSI Quattro |

|---|---|

| 2023 | BMW 330e |

| 2023 | BMW X5 xDrive45e |

| 2023 | Chrysler Pacifica |

| 2023 | Ford Escape |

| 2023 | Jeep Grand Cherokee 4xe |

| 2023 | Jeep Wrangler 4xe |

| 2023 | Lincoln Aviator Grand Touring |

| 2023 | Lincoln Corsair Grand Touring |

| 2023 | Volvo S60 Recharge |

| 2023 | Volvo S60 t8 Recharge |

What cars will qualify for the EV tax credit after April 18?

On March 31, the Treasury released additional guidance for battery manufacturing and mineral sourcing that take effect on April 18, 2023. The department won’t release a list of qualified models until the regulations are published in the Federal Register on April 17, when it will also share details on how much of the credit each qualifies for. Standards for income level and vehicle price are already set, which can help you narrow your options. But if you are considering purchasing an EV on or after April 18, check with the manufacturer or dealer about its eligibility. GM has said that at least three of its cars — the Cadillac Lyriq and the new Chevrolet Equinox EV SUV and Blazer EV SUV — already qualify for the full $7,500 credit.

Can I claim the EV tax credit on a used EV?

Beginning in tax year 2023, qualifying plug-in electric or fuel-cell EVs can qualify for a tax credit of up to $4,000, limited to 30% of its purchase price. There are certain restrictions:

- The used EV tax credit can only be claimed once in a vehicle’s lifetime. Subsequent owners will not be eligible.

- The MSRP of the car must be $25,000 or less.

- The car must be at least 2 years old. If you purchased it in 2023, for example, it must have a model year of 2021 or earlier.

- Used vehicles purchased before 2023 are not eligible.

- The vehicle must have been purchased from a qualified dealer who reports the transaction to the IRS.

- The vehicle must otherwise meet the requirements for the EV credit.

Below are income caps for owners of used EVs wishing to claim the credit.

Used EV income cap

| Filing status | Modified adjusted gross income |

|---|---|

| Single | $75,000 |

| Head of household | $112,500 |

| Married, filing jointly | $150,000 |

| Married, filing separately | $75,000 |

Do individual states have EV tax incentives?

In addition to the federal EV tax credit, a number of states offer rebates for clean vehicles. Some can’t be taken in conjunction with the federal credit, so be sure to get all the information before claiming anything.

California’s Clean Vehicle Rebate Project offers credits of between $1,000 and $7,000 for the purchase or lease of certain new EVs, plug-in hybrids and fuel-cell vehicles. EnergySage, an online marketplace for home solar-energy solutions, has a list of state rebate programs.

The Energy Department’s Alternative Fuels Data Center has information on various incentives offered by states, utilities and private organizations.

Do I get a tax credit for installing an EV charger?

The Inflation Reduction Act also extended the tax break for residential charging systems through 2032 and made it retroactive to Jan. 1, 2022.

It’s worth $1,000, or 30% of the cost of buying or installing the system, whichever is less.

The credit now also applies to bidirectional charging equipment, which lets you use your EV to power other appliances or even your home. Not many models have that capability, but it can be handy in an outage or other emergency. To claim the Alternative Fuel Vehicle Refueling Property Credit, you must file IRS Form 8911.

For more on EVs, find out how you can finance a home EV charger and get under the hood with Tesla’s new EV motor.

The post EV Tax Credit: Which Models Will Qualify for the $7,500 Tax Break After April 18? first appeared on Joggingvideo.com.

]]>The post When Are Taxes Due This Year? Where Has the Filing Deadline Been Extended? first appeared on Joggingvideo.com.

]]>This story is part of Taxes 2023, CNET’s coverage of the best tax software, tax tips and everything else you need to file your return and track your refund.

If you’re not one of the nearly 72 million Americans that has already filed their 2022 federal tax return, there are less than three weeks until Tax Day. While most Americans need to file by April 18, there are some exceptions. The IRS has granted extensions to residents in several states impacted by severe weather an extension.

And when it comes to state returns, most states adhere to the federal government’s timetable, but some have their own schedule. Here are all the deadlines you need to know for tax year 2022.

For more on taxes, learn how to set up an account on the IRS website, and how to file on your phone.

When are federal tax returns due?

For most Americans, the deadline to file federal tax returns is Tuesday, April 18, 2023. That’s because April 15 is on a Saturday and the next weekday, April 17, is recognized as Emancipation Day in Washington, DC. According to the IRS, “by law, Washington, DC, holidays impact tax deadlines for everyone in the same way federal holidays do.”

The agency has, however, delayed the filing deadline in states impacted by severe weather conditions over the past several months.

- New York residents impacted by winter storms and snowstorms in December have until May 15, 2023, to file their returns and make payments.

- Taxpayers in Mississippi affected by tornadoes and severe storms in March now have until July 31, 2023.

- Due to storms, mudslides and other natural disasters this winter, the IRS has also given residents of Alabama, California and Georgia until Oct. 16, 2023, to file federal returns and make payments.

The updated list of localities eligible for extensions is available on the Tax Relief in Disaster Situations website.

If you’re serving in the military abroad, including in a combat zone, you may also be granted additional time to file your return.

When is the deadline if I file for an extension?

Taxpayers requesting a filing extension on their federal return will have until Oct. 16, 2023.

Filing an extension doesn’t push back your payment deadline, though. You still need to submit anything you owe on time to avoid late penalties. An extension just gives you more time to complete your return.

When are state taxes due?

Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming do not have state income taxes.Of the 41 states that have income taxes, most are adhering to the April 18 federal filing deadline. There are some exceptions.

State tax deadline exceptions

| State | Deadline |

|---|---|

| Iowa | May 1 |

| Virginia | May 1 |

| Delaware | May 2 |

| Louisiana | May 15 |

California has extended the deadline for state returns for residents affected by severe weather to May 18, 2023. To date, the other states with extensions for filing federal returns have not changed the deadline for state returns.

As with federal returns, you can always request an extension on your state return. In most cases, you’ll still have to make any outstanding payments by the original deadline.Check with your state department of revenue for the most current information.

When can I expect my refund?

The agency says taxpayers who file electronically and are due a refund can expect it within 21 days — if they choose direct deposit and there are no issues with their return. By law, the IRS must wait to issue refunds to taxpayers who claimed the Earned Income Tax Credit or Additional Child Tax Credit. According to the agency, those payments should be received by Feb. 28.

For more on taxes, find out about changes in the law that could affect your tax refund, learn which tax-prep software is the best and get the download on tax breaks for homeowners.

The post When Are Taxes Due This Year? Where Has the Filing Deadline Been Extended? first appeared on Joggingvideo.com.

]]>The post Social Security COLA for 2023: Here’s How Much More You’ll Be Getting Next Year first appeared on Joggingvideo.com.

]]>

Next year, Social Security benefits will see a cost-of-living adjustment, or COLA, of 8.7% — the largest since 1981, when the increase hit an all-time high of 11.2%.

“A COLA of 8.7% is extremely rare and would be the highest ever received by most Social Security beneficiaries alive today,” Senior Citizens League policy analyst Mary Johnson said in a statement earlier this year.

In fact, the annual adjustment has risen above 7% only five times since 1975, when it was introduced. (The 2022 COLA, for example, was 5.9%.)

The benefits increase, announced on Oct. 13, is tied to the Consumer Price Index, which charts year-over-year price fluctuations for goods and services in the third quarter.Read on to learn more about Social Security benefits for 2023, including when the increase will begin and how to find out how much you’ll be getting. (Note that Supplemental Security Income beneficiaries will get their first COLA increase in December.)

For more on Social Security, learn when checks go out, how to access your payments online and how benefits are calculated.

What is the cost of living adjustment (COLA)?

Since 1975, Social Security benefits have been adjusted automatically each year, based on fluctuations in inflation, as determined by the Consumer Price Index For Urban Wage Earners And Clerical Workers. The Social Security Administration compares the average CPI-W in the three months of the third quarter of the current year to the same timeframe in the year prior. “The COLA increase is a valuable feature that keeps retirees from truly being tied to a ‘fixed income’ when managing expenses,” Rob Williams, managing director of financial planning at Charles Schwab, told CNET. The benefit increase is tied to the Consumer Price Index, which charts year-over-year price fluctuations for goods and services in the third quarter. The CPI was 8.5% in July and dipped down to 8.3% in August. In September it was 8.2%, according to the Department of Labor Statistics.

How much will Social Security benefits increase in 2023?

The 2023 COLA is 8.7%. Here’s how that breaks down for different groups, according to the Social Security Administration.

|

Category |

Average monthly increase |

Average 2023 check |

|

Retiree |

$146 |

$1,827 |

|

Worker with disabilities |

$119 |

$1,483 |

|

Senior couple, both receiving benefits |

$238 |

$2,972 |

|

Widow(er) |

$137 |

$1,704 |

|

Widow(er) with two children |

$282 |

$3,520 |

Predictions fluctuated greatly earlier this year: In June, the nonpartisan Committee for a Responsible Federal Budget estimated benefits would increase as much as 10.8%.

In July, Marc Goldwein, the organization’s senior policy director, predicted that if inflation remained on its then-current trajectory, the increase would be 11.4%, the highest ever. But, by August, Richard Johnson, director of the retirement policy program at the Urban Institute, told AARP that “somewhere in the 9% range is probably a reasonable guess.”

When will I know what my Social Security benefits are for 2023?

Beneficiaries should receive letters in December detailing their specific benefit rate for next year. If you miss this letter, you can still verify your increase via the My Social Security website.

When will I see the increase in my Social Security check?

The COLA goes into effect with December benefits, which appear in checks received in January 2023. Social Security payments are made on Wednesdays, following a rollout schedule based on the beneficiary’s birth date. So if you were born from the 1st through the 10th of the month, your benefits are paid on the second Wednesday of the month.

If your birthday falls between the 11th and 20th of the month, your checks are paid on the third Wednesday, and you’ll see your first COLA increase on your Jan. 18 check.

Those born between the 21st and the end of the month receive benefits on the fourth Wednesday, which, in 2023, is Jan. 25.

The post Social Security COLA for 2023: Here’s How Much More You’ll Be Getting Next Year first appeared on Joggingvideo.com.

]]>The post When Is the Deadline to Apply for Student Debt Forgiveness? first appeared on Joggingvideo.com.

]]>

More than 8 million people have applied for student debt relief since the Education Department’s site went live late Friday night, according to US President Joe Biden.

The application is “easy, simple and fast,” Biden told reporters at a briefing Monday.

The White House said in court documents that the earliest it will start to erase debt is Oct. 23. But if you’re among the 45 million Americans eligible for up to $10,000 in student loan forgiveness — or $20,000 if you received a Pell Grant — you can start the online application process now.

What’s the deadline to file for student loan forgiveness?

Borrowers have until Dec. 31, 2023, to submit an application for student debt relief. The White House is encouraging individuals to submit forms before mid-November, though, so they can be processed before student loan payments and interest resume on Jan. 1, 2023.

What do I need to fill out the federal student loan debt relief application?

The online form takes only a few minutes to complete: All you need to do is enter your name, birth date, Social Security number, email address and phone number, and then e-sign a statement indicating that you’re eligible for relief.

Though the relief program is available only to borrowers making less than $150,000 — or $250,000 for married couples filing jointly — you don’t need to upload documents certifying your income.

Do all borrowers need to file an application to be considered for student debt relief?

Borrowers whose income data is already on file with the federal government don’t need to file an application. They’ll automatically have up to $20,000 in student loans forgiven, according to the White House.It’s estimated that up to 8 million Americans fall into that category, most notably individuals who filed a FAFSA, or Free Application for Student Aid, for the 2022-23 school year and people enrolled in income-driven repayment programs that allow them to make fixed monthly payments.

Borrowers who fall into this category will receive an email or text notification explaining their status, according to the Education Department. But even if your debt is being wiped out automatically, many experts advise filling out the form anyway. “With any new government program, there is a risk of glitches, so it is best to apply just in case,” student-loan expert Mark Kantrowitz told CNBC.

In addition, filing out the form will get your request processed faster, as automatic forgiveness won’t be processed until after Nov. 14, 2022, the deadline to opt out of it.

According to the Federal Student Aid website, “if you would like to opt out of debt relief for any reason — including because you are concerned about a potential state tax liability — contact your loan servicer by phone or email and tell them.”You can find contact info for the major student loan servicers here.

Are all borrowers eligible for debt forgiveness?

No. In addition to establishing income caps, the program excludes private student loans — including federal loans owned by private banks, unless they’ve already been consolidated through the government’s direct lending program.

Borrowers with loans administered through the now-defunct Federal Family Education Loan program or who have Perkins loans aren’t eligible for debt forgiveness at this time.

This change in guidance, which reverses eligibility for roughly 770,000 borrowers, was announced in late September shortly after a half-dozen Republican-led states filed a legal challenge to the forgiveness plan.

“We are working on pathways to support those [borrowers],” Secretary of Education Miguel Cardona said in Monday’s briefing. “But we’re moving as quickly as possible to provide relief to as many people as possible.”

For more about student loan debt relief, learn whether your forgiveness will be taxed by your state, how erasing student debt could impact your credit score and how to request a refund of loan payments made during the pandemic.

The post When Is the Deadline to Apply for Student Debt Forgiveness? first appeared on Joggingvideo.com.

]]>The post You Have Less Than Two Weeks to Claim Money From AT&T’s $14 Million Hidden Fee Settlement first appeared on Joggingvideo.com.

]]>

Current and former AT&T customers may be eligible for a piece of a $14 million settlement, but the deadline is swiftly approaching.AT&T agreed to the massive payout after a class action lawsuit alleged it charged subscribers hidden fees for years: In court filings, plaintiffs in Vianu v. AT&T Mobility argued the telecom company failed to inform postpaid wireless customers they were being charged a monthly $1.99 administrative fee that they say was really a way to increase the base rate “without having to advertise the higher prices.” (Unlike prepaid subscribers, postpaid customers are billed based on their usage after the fact.)

AT&T has denied the allegations. In an email to CNET, the company said it “clearly and prominently” discloses all fees and only agreed to the settlement “to avoid lengthy and expensive litigation.”

Here’s what you need to know about the AT&T hidden fee case, including who’s eligible for a payment, when the deadline to file is, and how much qualified customers could get. Scroll down for more on how to file a claim.Want to find out about more class-action settlements? See if you qualify for payouts from T-Mobile’s $350 million data-breach deal or Roundup weed killer’s $45 million settlement.

What is AT&T accused of in the class-action lawsuit?

Eligible customers must file a claim by Oct. 29, 2022, to receive a share of the payout.

SOPA Images/Getty Images

In the suit, filed in the US District Court for the Northern District of California, plaintiffs Ian Vianu, Elizabeth Blum and Dominic Gutierrez allege a monthly administrative fee attached to each wireless line in May 2013 is really a way for AT&T to increase its basic rate “without having to advertise the higher prices.”

The fee has been regularly raised since then — it more than doubled in 2018 to $1.99 a month — even though AT&T financial records allegedly show the company’s administrative costs have actually been decreasing.

According to the complaint, mention of the fee is intentionally buried in bill statements “to [make] it likely customers will not notice it.” It’s also phrased to suggest that it’s akin to a tax or regulatory fee, the suit reads, “when in fact it is simply a way for AT&T to advertise and promise lower rates than it actually charges.”

Calling the practice a “bait-and-switch scheme,” the plaintiffs maintain AT&T has “unfairly and improperly extracted hundreds of millions of dollars in ill-gotten gains from California consumers.”

Their complaint accuses the carrier of violating several California statutes regarding unfair, unlawful and fraudulent business practices, as well as “the implied covenant of good faith and fair dealing.”

Who is eligible for money from the AT&T settlement?

While all postpaid customers were charged the fees, only California residents are eligible for payment in this case. That’s because the California Consumers Legal Remedies Act protects residents against “false advertising, fraud, and other unfair business practices.”

AT&T customers in California who were charged administrative fees on their postpaid wireless service plans between June 20, 2015, and June 16, 2022, can file a claim for a one-time cash payment. It’s not clear how many subscribers AT&T has in California, although, with more than 80 million postpaid customers across the country, it is the third-largest mobile carrier in the US.

How much will eligible customers receive in the settlement?

Class members who successfully file a claim will receive an equal share of the $14 million settlement. According to the settlement website that’s currently estimated to be $20, but the final amount may be higher or lower depending on the number of claimants, as well as attorneys’ fees.

Current AT&T subscribers would receive their refund via an automatic credit to their account, while former customers would get a check mailed to them.

The payments won’t be a full reimbursement: According to AT&T records, the average customer has paid $180 in fees since 2015, The Verge reported, two years after the practice began.

How do I file a claim for payment from the AT&T settlement?

If you believe you’re eligible for a portion of the settlement, you can submit a claim on this website or print out a physical form to mail in.

You’ll be asked for your name, mailing and email addresses and AT&T Wireless phone number or account number. Claims must be submitted by Oct. 29, 2022.

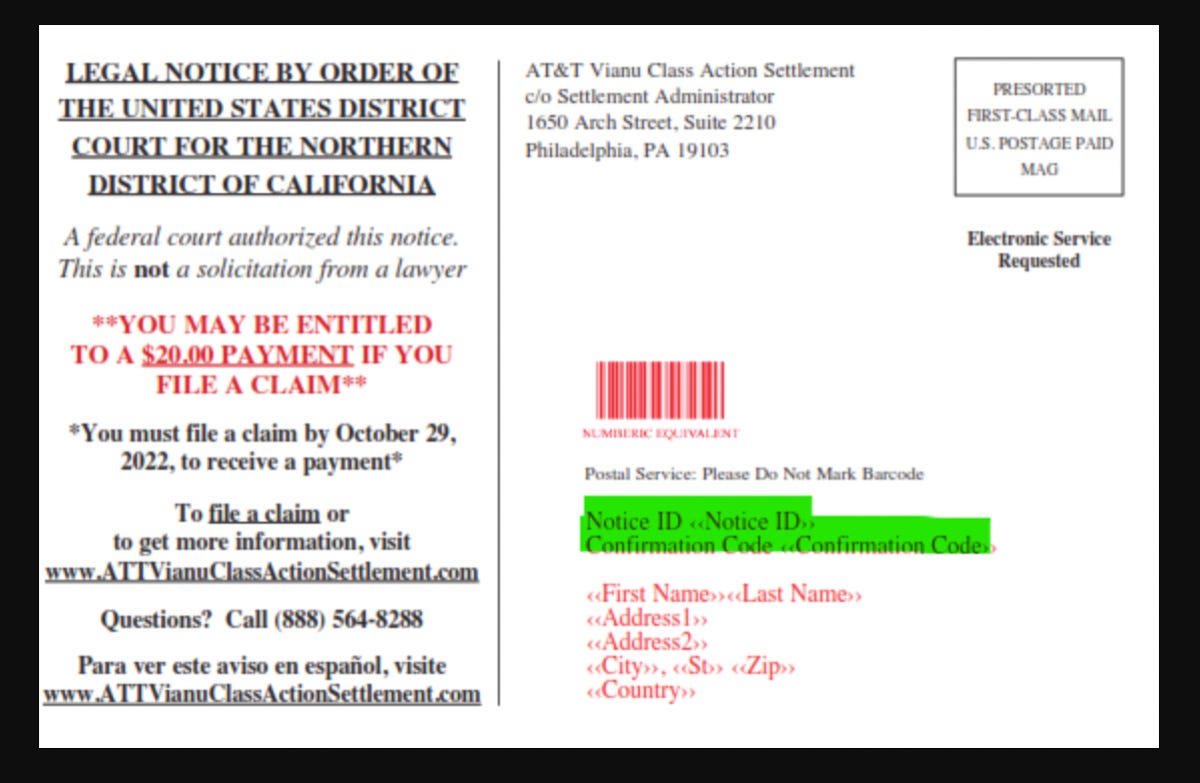

A sample postcard sent to eligible class members in the AT&T class-action settlement.

Vianu v. AT&T Mobility

Some class members received emails or postcards notifying them of the potential settlement with a Notice ID and Confirmation Code. If you received a notification, include the ID and code provided when you file. If you didn’t receive a postcard or email — or do not know where it is — you can still file without them.

The deadline to opt out of the settlement and retain the right to pursue your own lawsuit was Sept. 29, 2022.

When will class members receive payment from the AT&T settlement?

Any compensation will be disbursed after the final approval hearing for the deal, scheduled for Nov. 3.

The post You Have Less Than Two Weeks to Claim Money From AT&T’s $14 Million Hidden Fee Settlement first appeared on Joggingvideo.com.

]]>The post Still Using an iPhone 5S or 6? You Better Download This iOS Security Update first appeared on Joggingvideo.com.

]]>

Most Apple devotees are readying for the imminent release of the iPhone 14 on Sept. 7. But if you’re still rocking an iPhone 5S, 6 or 6 Plus, it’s time to download a security patch intended to block malware.

On Wednesday, Apple released an updated version of iOS 12, which was first launched way back in September 2018. The fix in iOS 12.5.6 is intended to patch up a security vulnerability that could let a malicious website run unchecked code if you opened it on a browser on your phone.

“Processing maliciously crafted web content may lead to arbitrary code execution,” reads a note on the Apple support site. Without giving details, Apple said the flaw “may have been actively exploited.”

The WebKit vulnerability was already fixed in iOS 15.6.1, iPadOS 15.6.1 and MacOS Monterey 12.5.1 updates, according to MacRumors.

You can find and download iOS 12.5.6 by going to Settings on your phone, clicking on General and selecting Software Update.

The iPhone 5S was first unveiled in September of 2013, followed by the 6 and 6 Plus a year later. The update is also available for several other antique devices, including the original iPad Air, the iPad Mini 2 and 3, and the sixth-generation iPod Touch.

Read more: Best iPhone in 2022: Which of Apple’s Phones Is Right for You?

The post Still Using an iPhone 5S or 6? You Better Download This iOS Security Update first appeared on Joggingvideo.com.

]]>The post iPhone 14 Is Coming Soon: Report Points to a Sept. 16 Release Date first appeared on Joggingvideo.com.

]]>

What’s happening

Apple’s expected iPhone 14 will reportedly go on sale in mid-September after being unveiled during an online launch event.

Why it matters

The iPhone 14 is expected to bring a variety of exciting upgrades, but it’ll face a tough market as people grapple with higher prices on everyday necessities.

What’s next

We’ll be keeping an eye out for official details on a fall event from Apple.

Apple is preparing to announce the iPhone 14 at a launch event on Sept. 7, with sales of the rumored iPhone starting on Sept. 16, according to a report Wednesday from Bloomberg.

Read more: How Much Will the iPhone 14 Cost? Here’s What Rumors Say

That rollout plan would follow Apple’s habit of making new products available about a week or so after they’re unveiled. Apple store employees have been told to prepare for “a major new product release” on Sept. 16, Bloomberg reported.As it has throughout the pandemic, the company will reportedly stream the launch event online rather than hold it in person.

Read more: What Could Apple’s iPhone 14 Look Like?

Apple didn’t respond to a request for comment about the possible launch date of the expected iPhone 14 but previous iterations of the iPhone have launched in early September, typically on a Tuesday or Wednesday, with sales starting on the Friday of the following weekApple’s iPhone 13 event was held on Tuesday, Sept. 14, 2021, and the phones went on sale on Friday, Sept. 24. Sept. 7, 2022, is a Wednesday, and Sept. 16, 2022, is a Friday.

Now playing:

Watch this:

What iOS 16 May Tell Us About the iPhone 14

7:39

The iPhone 14 is expected to feature the same 6.1-inch size as the iPhone 13, with a 6.7-inch Pro Max model, as well. But Apple is reportedly doing away with the 5.4-inch Mini, due to sluggish sales.

A notchless display and a 48-megapixel camera are expected on the Pro model, among other changes.

The iPhone 14 is also rumored to come with a $100 price hike. There weren’t any price changes between the iPhone 12 and iPhone 13, but the new model comes as Apple’s supply chain has seen cost increases.

New iPads, Macs and Apple Watches are also expected to launch this fall.Read on: All the Rumors About the Upcoming iPhone 14

The post iPhone 14 Is Coming Soon: Report Points to a Sept. 16 Release Date first appeared on Joggingvideo.com.

]]>The post Apple to Delay Rollout of iPadOS 16 Until October, Report Says first appeared on Joggingvideo.com.

]]>

Apple fans are gearing up for the public release of iOS 16, expected in September. But iPad owners may have to wait a bit longer. The tech giant is expected to delay the release of iPadOS 16 by about a month to give developers time to iron out bugs, Bloomberg reported on Wednesday.

If accurate, this would mark the first time in years that iPadOS and iOS haven’t been launched in tandem. The latest versions of the operating systems were announced earlier this year at WWDC.

Read more: Hidden iOS 16 Features and Settings You’ll Want to Know About

The new iPadOS 16 update includes Stage Manager, a feature that allows users of the newest M1 iPad Pro to multitask, resize windows and drag multiple apps at a time. But according to Bloomberg, people who downloaded the available beta version of iPadOS 16 found Stage Manager to be buggy with a confusing interface.

The delay could mean the updated operating system will launch alongside the rumored M2 iPad Pro, which could be coming in the fall.

Apple didn’t immediately respond to a request for comment.

More to come.

The post Apple to Delay Rollout of iPadOS 16 Until October, Report Says first appeared on Joggingvideo.com.

]]>The post Meta Is Pulling the Plug on Facebook Live Shopping first appeared on Joggingvideo.com.

]]>

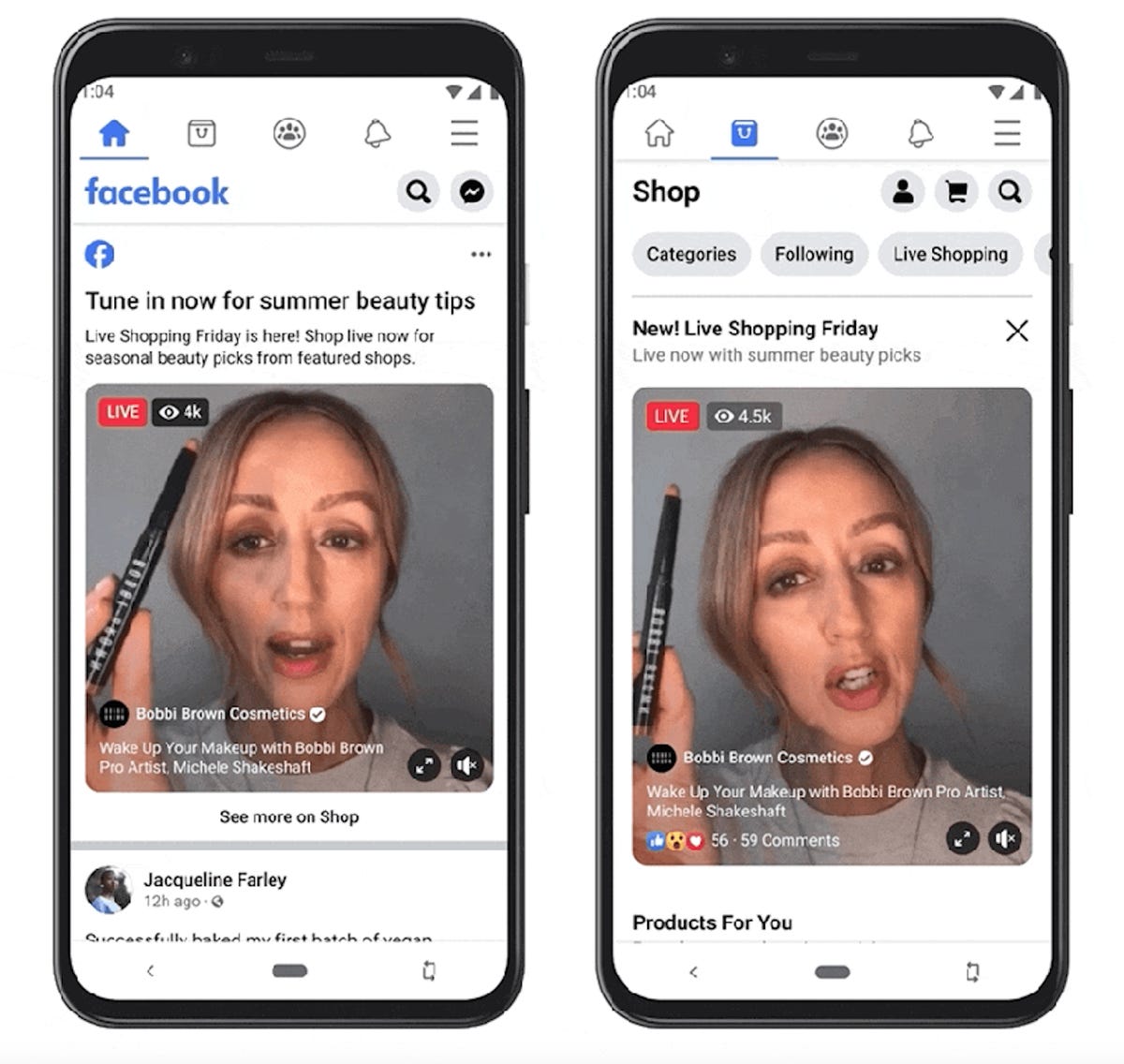

After less than two years, Facebook is shuttering its live shopping feature, parent company Meta announced in a blog post Wednesday.As of Oct. 1, users will no longer be able to host any new or scheduled Facebook Live Shopping events. Facebook Live will continue, the company said, but you won’t be able to create product playlists or tag products in your Facebook Live videos.”As consumers’ viewing behaviors are shifting to short-form video, we are shifting our focus to Reels on Facebook and Instagram,” the post said, suggesting users try tagging products in Reels on Instagram as a possible substitute.

A makeup tips video on Facebook Live Shopping.

Meta

After some trial runs and beta testing, Facebook made livestream shopping widely available in November 2020. Live Shopping Fridays was added the following May, offering demos, tutorials and other videos from retailers like Abercrombie & Fitch, Bobbi Brown Cosmetics and Clinique.

Previously filmed shopping segments can still be preserved, according to Meta, by downloading them onto your profile page or in Creator Studio.The announcement comes just weeks after TikTok reportedly dropped plans to expand its own live e-commerce initiative, TikTok Shop, to the US and mainland Europe.

The post Meta Is Pulling the Plug on Facebook Live Shopping first appeared on Joggingvideo.com.

]]>