These days, you don’t really need a financial planner to help you keep a handle on your money. For most people, a few mobile apps can help you make sure your bills get paid, that you’re spending smart, and you’re saving for the future.

I’ve rounded up several apps that pay attention to your money for you, offering advice, helping stick to a budget or even protecting you from fraud.

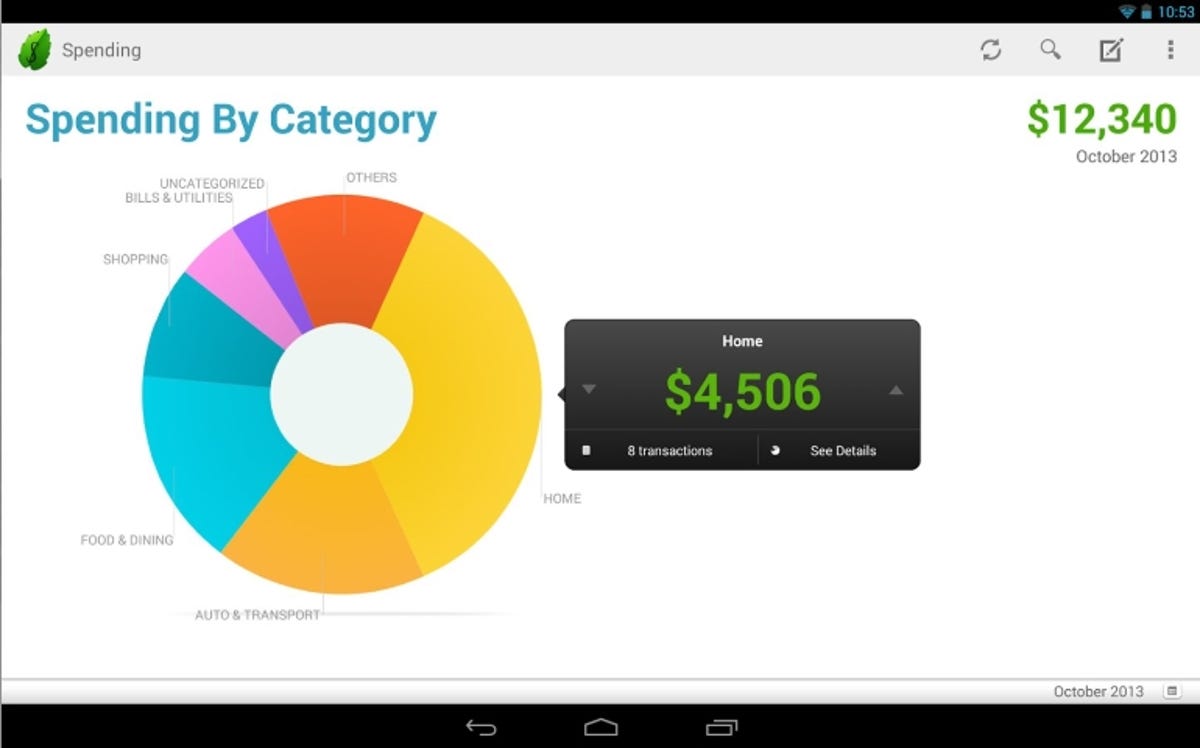

Mint

Mint

Free, iOS, Android and Windows Phone

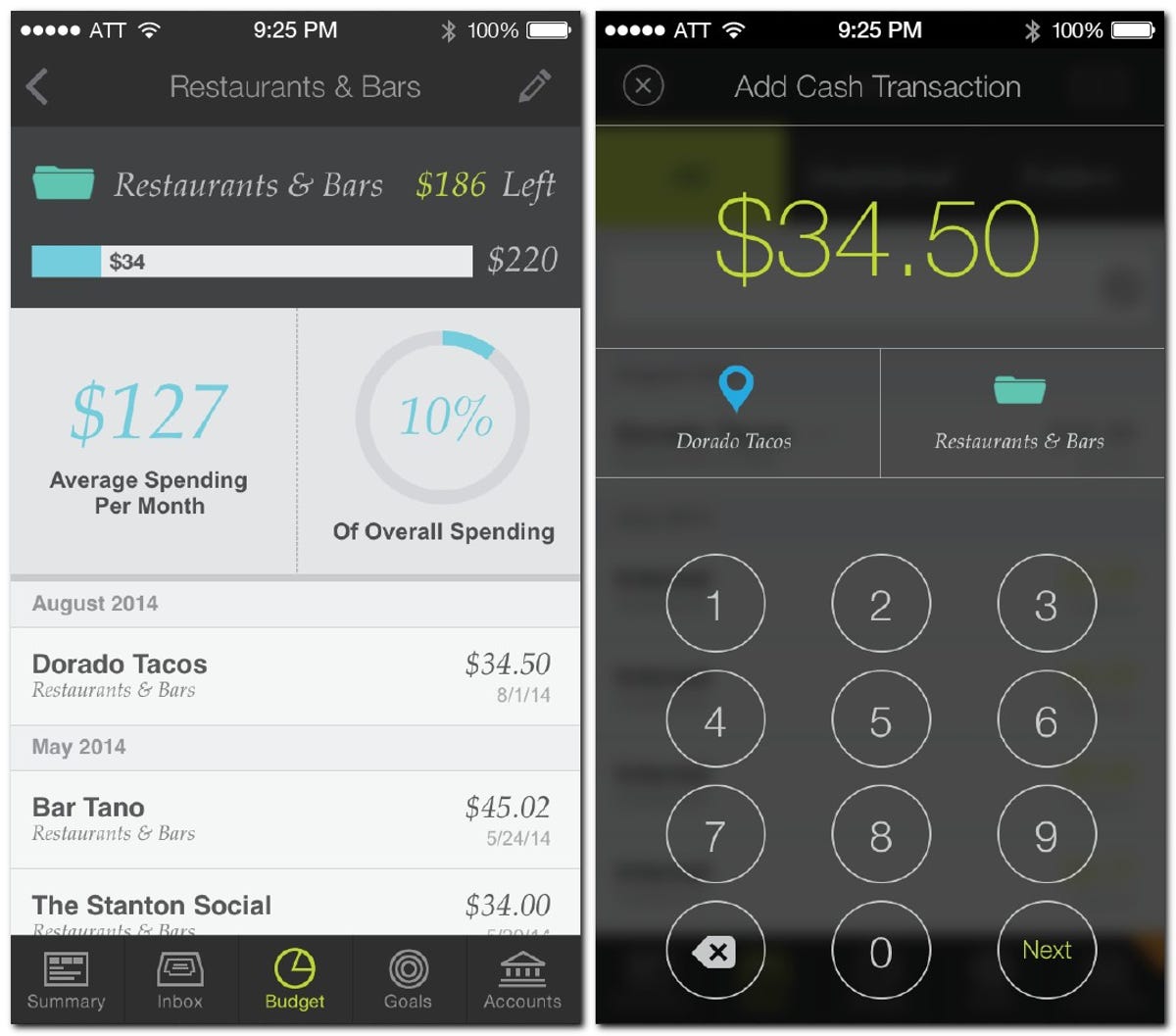

It’s hard to talk about budgeting apps without talking about Mint, one of the most popular money management services. The app and Web service pulls in data from your bank accounts, credit cards and loans to give you a full picture of your net worth and financial health.

You can set up budgets for nearly anything, then Mint will categorize all of your spending to make sure you stay in check. You can also create savings goals, such as paying off your credit cards or saving for a new car, and the service will coach you along the way.

What’s great: Mint categorizes most of your purchases so you don’t have to.

What’s not: The service can be overwhelming to use at first, and managing budgets can be tedious.

Screenshot by Sarah Mitroff/CNET

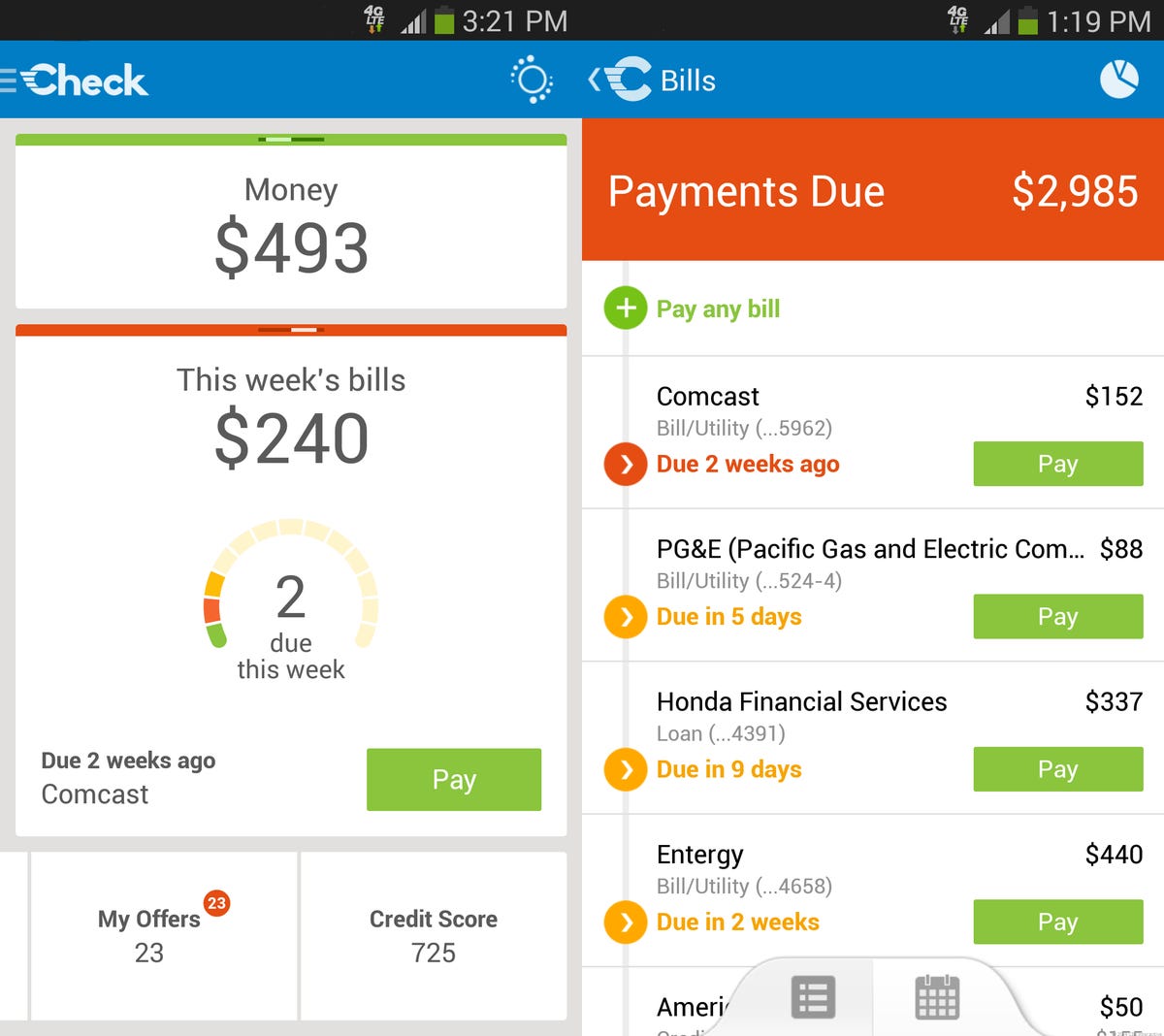

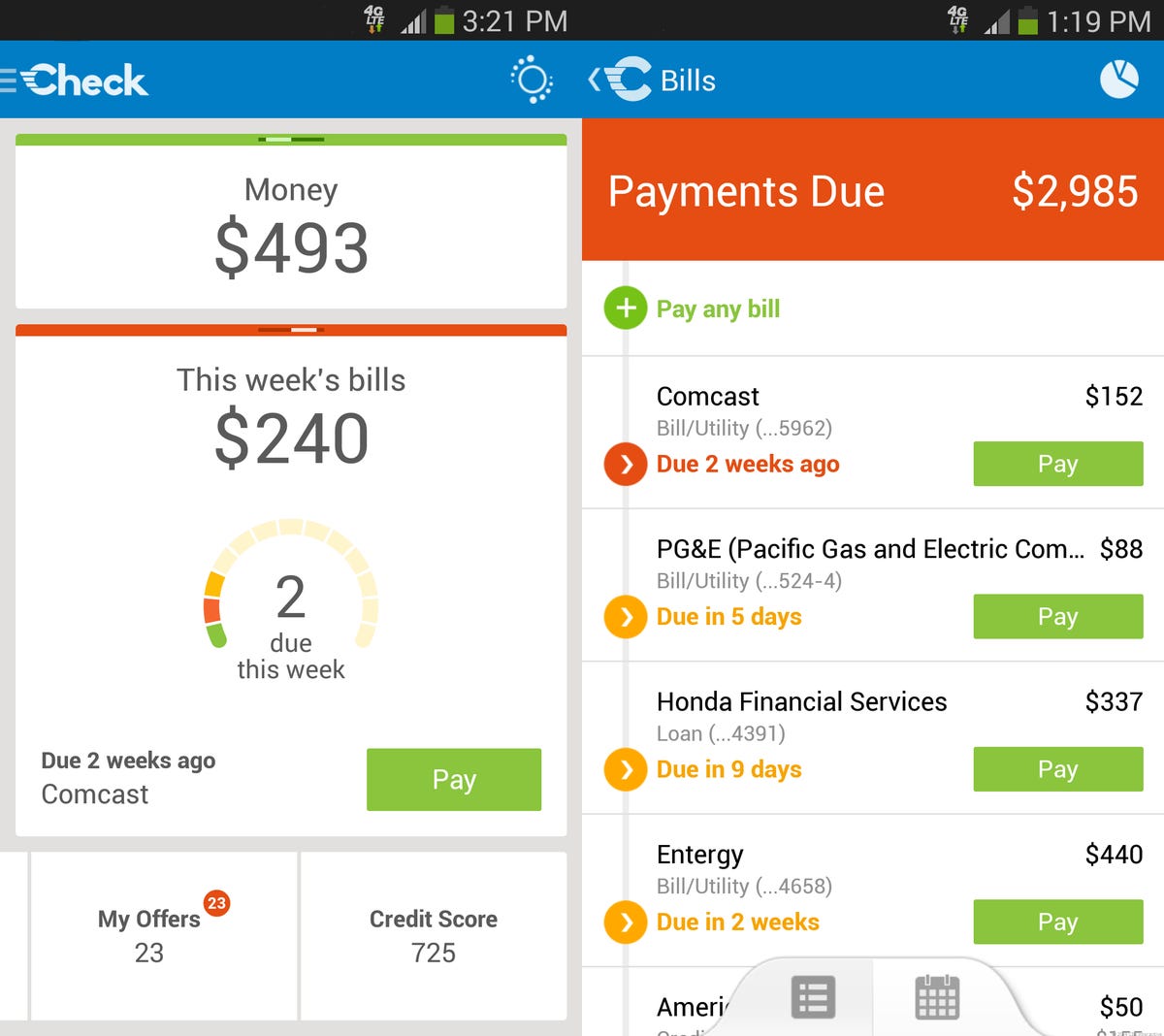

Check

This app helps corral all of your bills in one place, and then helps you pay them easily without going to each service’s website. You can log into your various accounts for your utilities, credit cards, cable subscriptions, loans and more, and then see a dashboard of what’s due next and when. You’ll get reminders for upcoming bills, and there’s a handy calendar view that shows all your bills’ due dates plotted out each month.

There are some fees associated with Check, but if you pay your bills with your bank account and pay them before the due date, you can avoid them.

What’s great: Check lets you either make a one-time payment, or set up recurring payments for your bills each month.

What’s not: Payments can take a few days to process.

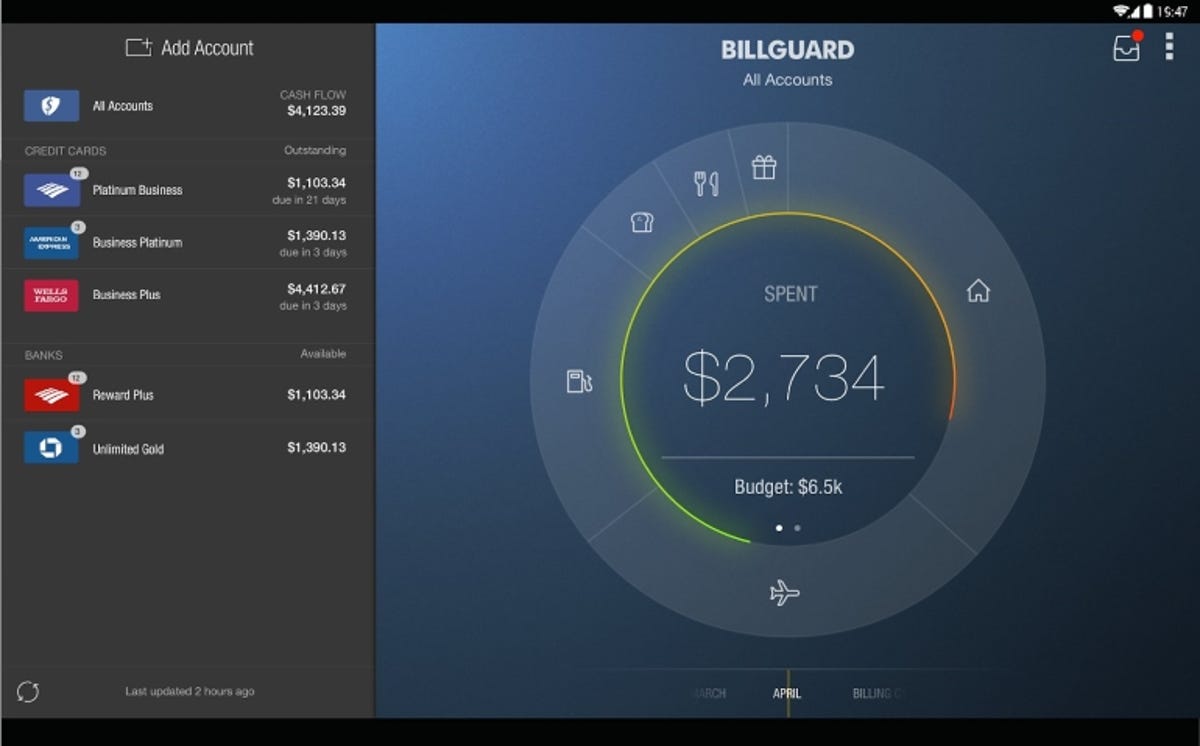

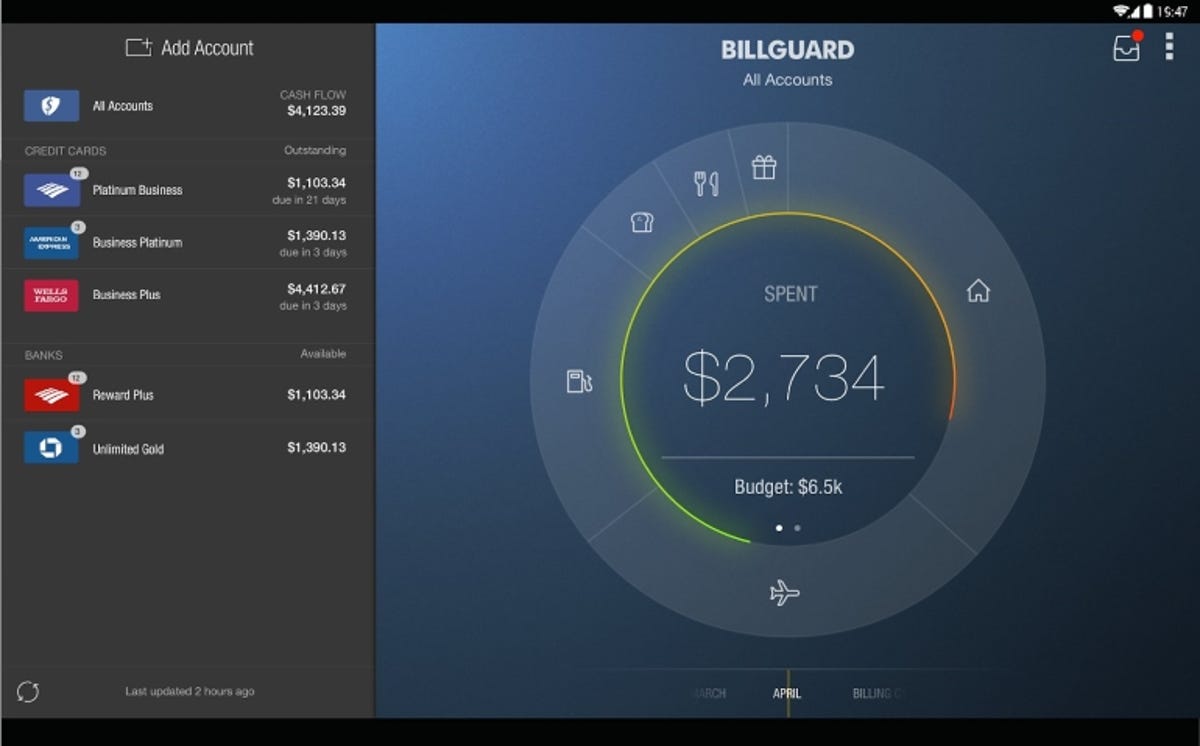

BillGuard

BillGuard

BillGuard focuses on protecting you from fraudulent charges. The app monitors your spending from your bank accounts and credit cards and helps you review your transactions to make sure everything is correct. If you see a mistake, you can request a refund from the vendor within the app.

One really powerful feature is the location-based fraud alerts, which show on a map where your card’s been used. You can also review purchases that BillGuard thinks are suspicious.

What’s great: The app’s design is really user-friendly, clearly explaining each transaction.

What’s not: The budget features can be a bit complicated.

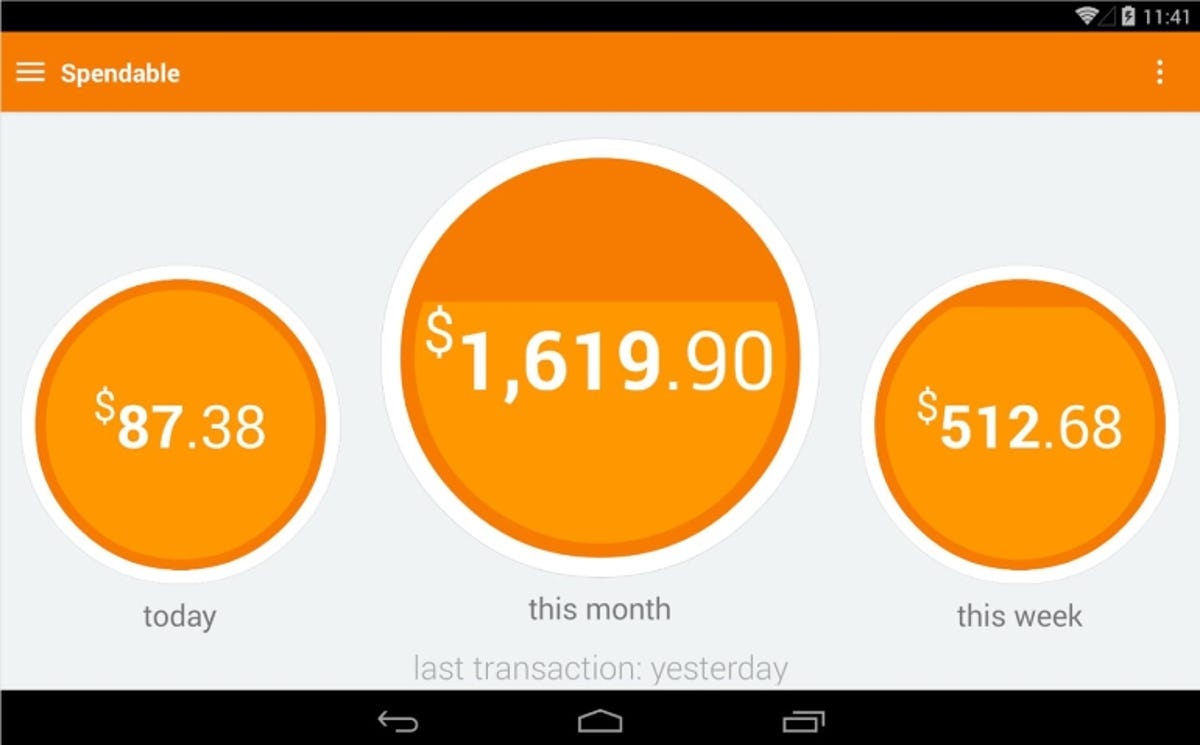

Level Money

Level Money

If you want a bit more discipline for how you spend your money day to day, Level Money is worth a shot. The app pulls in your income and spending from your bank accounts, then gives you daily, weekly and monthly spending goals.

Level’s design is dead-simple, with few distractions. You can easily see how much you’ve spent, and how much more you can comfortably spend each day or week. It also automatically categorizes each transaction, so you can get a feel for where your money is going.

The app works with Android Wear watches too, so you can see your daily spending allowance on your wrist.

What’s great: The app gives you concise spending limits, so you can stay within your budget.

What’s not: Level’s allowance approach won’t appeal to everyone, and it’s not great for tracking long-term financial goals.

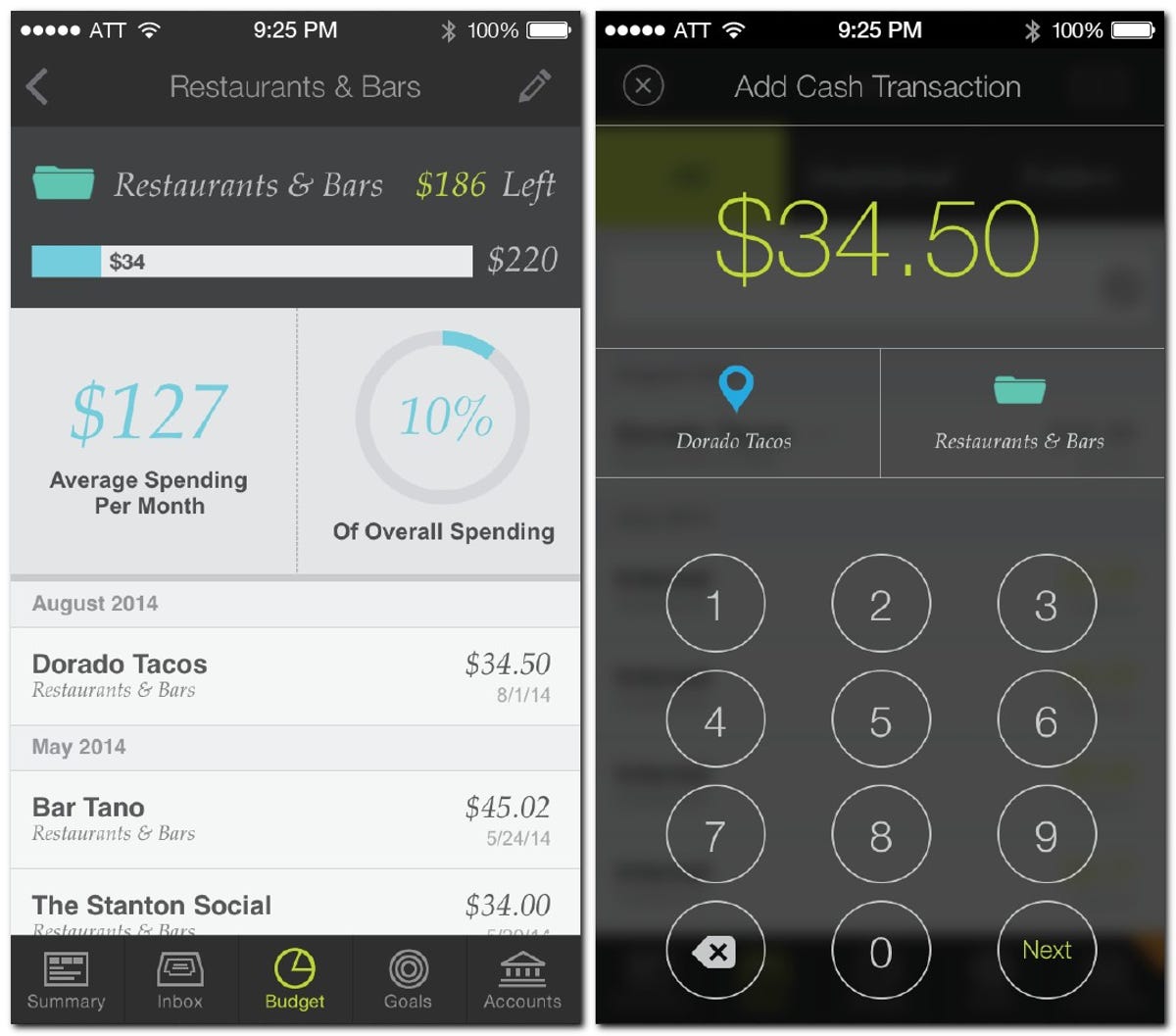

LearnVest

LearnVest

Free, iOS only

The final app on this list is designed to help get you more money than you have now. It does this by helping you stay within a budget so that you can pay down debts, save more money and invest.

The free Learnvest app gives you a place to track your day-to-day spending, as well as your bigger financial picture, to help you plan for the long term. The app also offers up articles to help you learn to manage your finances better.

With a premium membership, starting at $30 per month, you get a personalized financial plan that can help deal with any debts or increase your savings efforts. You can also consult with financial professionals live to ask questions or get help with important money situations, like buying a house.

What’s great: The app lets you add cash transactions manually, so you can track every penny you spend.

What’s not: There’s no app for Android, and you need to pay for a monthly plan to get advanced features.