The post Do Social Security Recipients Have to File Income Taxes? first appeared on Joggingvideo.com.

]]>This story is part of Taxes 2023, CNET’s coverage of the best tax software, tax tips and everything else you need to file your return and track your refund.

Most Americans have two weeks left before income tax returns are due to the IRS, but not everyone has to file taxes. If you received Social Security benefits in 2022, you might not have to file a tax return this year — that depends on a few factors, though.

Your age, your marital status and how much income you earn outside of Social Security benefits all have an impact on whether you need to submit a tax return to the IRS. And even if you aren’t required to file, it might be a good idea if you want to receive refundable tax credits or a refund for income taxes you paid during the year.

For more information on tax season, here’s an explanation of your Social Security Benefit Statement and the best tax software for filing your return in 2023.

How do I know if my Social Security benefits are taxable?

Your Social Security benefits may be taxable if one-half of your Social Security benefits plus all of your other income is greater than the base amount of your filing status (the base amount for determining tax liability) which is:

- $25,000 for single filers, head of household, or a qualifying surviving spouse

- $25,000 for married people filing separately who lived apart from their spouse in 2022

- $32,000 for married couples filing jointly

- $0 for married people filing separately who lived with their spouse

Other forms of income include wages, self-employment, interest, dividends and other reported taxable income.

One way to understand whether your benefits are taxable is to consider gross income, your total earnings before taxes.

You will need to file a return for the 2022 tax year:

- If you are an unmarried senior at least 65 years old and your gross income is more than $14,700.

- If you are filing a joint return with a spouse who is also 65 or older and your gross income is more than $28,700.

- If you are filing a joint return with a spouse who is under 65 years old and your gross income is more than $27,300.

Another way to understand whether your Social Security benefits are taxable is to look at combined income, which is your adjusted gross income + nontaxable interest + half of your Social Security benefits.

- If you are a single tax filer and your combined income is between $25,000 and $34,000, the SSA says you may have to pay income tax on up to 50% of your benefits.

- If you are a single tax filer and your combined income is more than $34,000, you may have to pay income tax on up to 85% of your benefits.

- If you are filing a joint return and your combined income is between $32,000 and $44,000, you may have to pay income tax on up to 50% of your benefits.

- If you are filing a joint return and your combined income is more than $44,000, you may have to pay income tax on up to 85% of your benefits.

- If you are married filing separately and didn’t live with your spouse last year, your Social Security benefits are taxed as if you were a single filer.

- If you are married and filing separately while living with your spouse you probably will have to pay taxes on your benefits.

On line 6b of Form 1040 or Form 1040-SR, you will report the taxable portion of your Social Security benefits.

Should I file a tax return even if I’m not required to?

The biggest reason to file a tax return even if you don’t have to is to receive a tax refund.

If you had federal tax income withheld from your pay or if you made estimated tax payments in 2022, you may want to file a tax return this year. You could receive a tax refund of any surplus withholding.

Another circumstance where filing is encouraged is if you qualify for tax credits that provide you with refunds, including the earned income tax credit, the child tax credit or the child and dependent care tax credit. The earned income tax credit is fully refundable, meaning it goes toward your tax refund if you have no tax liability.

How can I see my Social Security benefit amount for 2022?

The Social Security Administration sends out a Social Security Benefit Statement by mail or online in January with your benefits from the previous year disclosed inside. The information in the statement provides you with the earnings you will disclose in your tax return if you end up filing one.

For more information on Social Security and tax season, here’s a tax season cheat sheet and why you should create an online IRS account prior to tax season’s arrival.

The post Do Social Security Recipients Have to File Income Taxes? first appeared on Joggingvideo.com.

]]>The post Deduct These Work Expenses on Your Tax Return This Year first appeared on Joggingvideo.com.

]]>This story is part of Taxes 2023, CNET’s coverage of the best tax software, tax tips and everything else you need to file your return and track your refund.

Taxpayers have less than three weeks left (though some states get deadline extensions due to severe weather) to file their tax returns until the April 18 filing deadline hits. Before they do so, a major question lingers: Which work expenses are deductible? The simplest answer is it depends on the sort of work you do. The biggest deductions for work expenses are restricted to self-employed people and small business owners, but some full-time employees can get a few tax breaks too.

If you’re one of the many taxpayers who pivoted to remote work or started working for yourself, you can take advantage of a few deductions this tax season from the work expenses you incurred during 2022.

Learn which expenses you can deduct from your taxable income if you’re an employee or self-employed and how to claim them when you file your tax return this year.

For more, here are the best free tax filing options for 2023, why you should create an online IRS account before you file your taxes and how to track your tax refund.

Which work expenses can W-2 employees deduct from their taxes?

Unfortunately for W-2 employees, the Tax Cut and Jobs Act of 2017 eliminated almost all tax deductions for unreimbursed employee expenses.

Only a few specific types of W-2 employees can still claim work expenses:

- Reservists in the armed forces

- Qualified performing artists

- Fee-basis state or local government officials

- Employees with work expenses related to an impairment

Those eligible taxpayers can report and claim their unreimbursed work expenses using Form 2106, “Employee Business Expenses.” These expenses can include vehicle costs, travel costs, work clothes and meals, but the IRS has stringent rules for documentation — taxpayers must “prove the time, place, business purpose, business relationship (for gifts), and amounts of these expenses,” the instructions to the form explain. Receipts must be provided for all lodging expenses or for any work expense of $75 or greater.

Eligible educators working in kindergarten through 12th grade can also deduct some of their work expenses, including professional development and classroom supplies. Each eligible teacher can deduct up to $300 of unreimbursed expenses on line 11 of Form 1040 Schedule 1.

Eligible W-2 employees need to itemize to deduct work expenses

If you are an eligible W-2 employee, you can only deduct work expenses on your taxes if you decide to itemize your deductions. Your decision will depend on whether the total of your itemized deductions is greater than the standard deduction — $12,950 for single filers, $19,400 for head-of-household filers and $25,900 for married people filing a joint return.

Along with eligible work expenses, personal itemized deductions can include mortgage interest, retirement contributions, property taxes, charitable donations, medical expenses and student loan interest.

Most Americans choose the standard deduction when filing their taxes. It is a simpler route than itemizing your deductions, which requires further proof of expenses and receipts.

The IRS encourages taxpayers to itemize when your “allowable itemized deductions are greater than the standard deduction or you can’t use the standard deduction.”

Self-employed and business owners can deduct work expenses even if they take the standard deduction

If you’re self-employed or own a business, you can deduct business expenses on your taxes regardless of whether you take the standard deduction or itemize.

“Business expenses are known as above the line deductions which are available regardless of the choice to itemize. Consequently, a taxpayer could have substantial business expenses and still claim the standard deduction,” Eric Bronnenkant, CPA/CFP and Head of Tax at online financial advisor Betterment, told CNET in an email.

On Schedule C, freelancers and business owners will report their business income and work expenses. Bronnenkant said taxpayers should familiarize themselves with the form prior to filing.

“The IRS allows businesses to deduct ordinary and necessary business expenses. The key question: Was this an ordinary and necessary expense for the business activity? Notably, this excludes any personal expenses,” Bronnenkant said.

What is the home-office tax deduction and who can claim it?

The home office deduction is a major work expense deduction that self-employed people can claim. If you use your home office space for work purposes — and work purposes only — you may be eligible for the home office deduction.

The home office deduction has strict requirements you must follow to be eligible. First, you will need to be self-employed to take advantage of this deduction, meaning that you receive a 1099 form for self-employed workers and not a W-2 form for employees. Taxpayers must “exclusively and regularly” use a part of their home for work purposes, the IRS says. So your desk inside your bedroom doesn’t count, and remote employees working from home do not qualify.

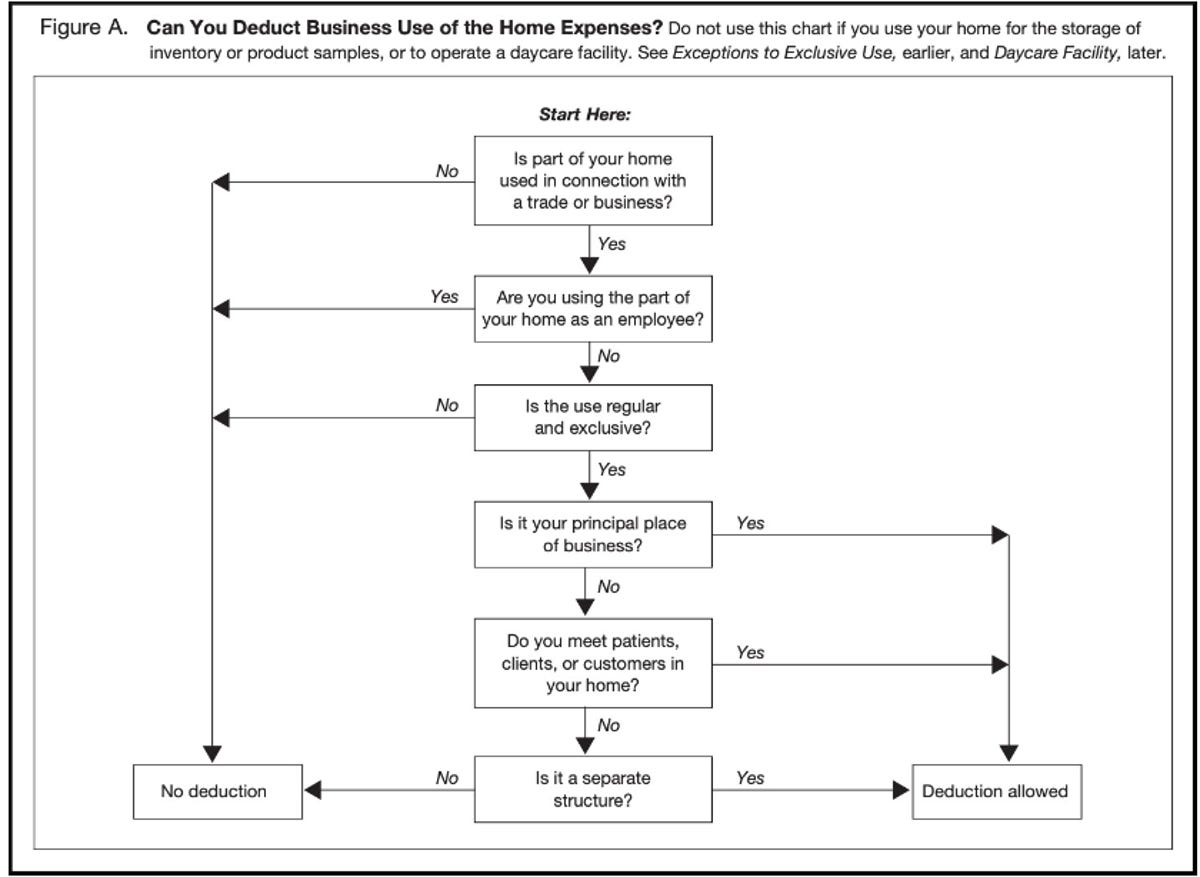

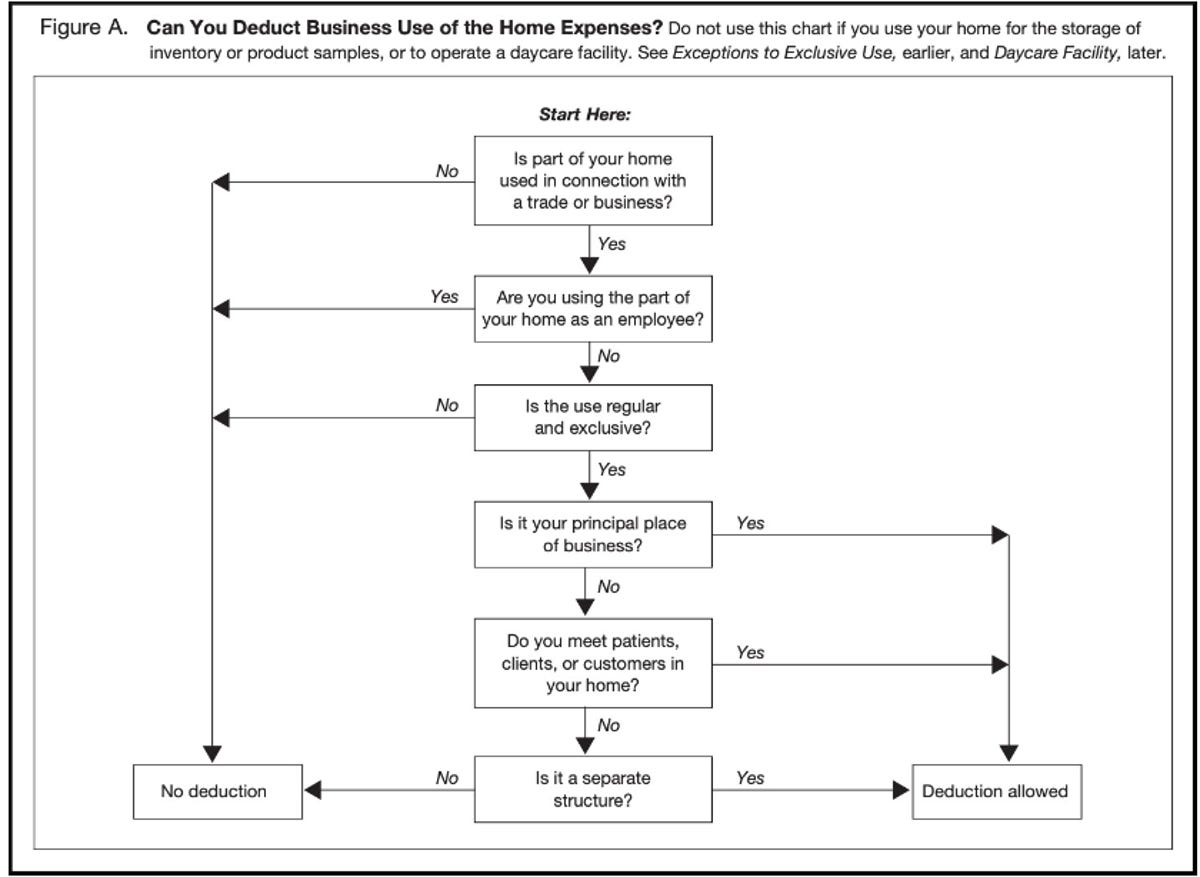

Use this chart to figure out whether your home expenses qualify for a deduction.

IRS

If you are eligible for the home-office deduction, there are two ways to calculate it. A simplified option introduced in 2013 lets taxpayers claim $5 per square foot of space used to a maximum of 300 square feet. The traditional “regular” method for claiming the deduction requires detailed records of all expenses.

To use the simplified method, you’ll complete the worksheet in Form 1040 Schedule C. For the regular method, you’ll need to complete and file Form 8829, “Expenses for Business Use of Your Home.”

How do I deduct the self-employment tax?

Self-employed workers may get substantial tax breaks like the home office deduction, but they also pay a hefty federal tax of 15.3% on their income. This self-employment tax is comparable to the Social Security and Medicare taxes that companies pay for employees.

Even if you are an employee of a company, if you earn more than $400 on freelance work you must pay self-employment tax on that income. The self-employment tax generally applies to 92.35% of your net income as determined on Schedule C.

The good news for self-employed taxpayers is that half of the self-employment tax is deductible. After you calculate the self-employment taxes that you owe using Schedule SE, you’ll take 50% of it and enter the deduction on line 15 of Form 1040.

Can I deduct health care premiums if I’m self-employed?

Yes, you can. If you work for yourself and weren’t eligible for an employer-provided health care plan in 2022, you can likely claim the cost of your health insurance premiums as an above-the-line deduction. That means you don’t need to itemize personal deductions to claim it.

These premiums can include medical, dental and qualifying long-term care insurance. You can claim them for yourself, a spouse or any dependents.

You can only claim insurance premiums up to the amount of business income that you earned in 2022. If your business didn’t make any money, you can’t claim any deduction.

Your deductions for long-term care insurance are limited by your age. Here are the deduction limits for 2022:

2022 Deduction Limits

| Taxpayer age | Long-term care premium limit |

|---|---|

| 40 or younger | $450 |

| 41 to 50 years old | $850 |

| 51 to 60 years old | $1,690 |

| 61 to 70 years old | $4,510 |

| 71 and older | $5,640 |

To take the self-employed health insurance premium deduction, you’ll enter the total amount you are claiming as an adjustment to income in Part II of Form 1040 Schedule 1.

What is the qualified business income deduction?

In addition to deducting business expenses, many freelancers, business owners and business partners can take advantage of the qualified business income deduction, Bronnenkant said. It allows business owners to deduct up to 20% of qualified business income plus 20% of qualified real estate investment trust dividends and qualified publicly traded partnership income.

To be eligible for the QBI deduction, you must either be a sole proprietor (including freelancers) or receive “pass-through” income from an S corporation, partnership or limited liability corporation (LLC). You can take the full QBI deduction if your income is less than $170,050 for single filers or $340,100 for joint filers. Higher incomes can claim a partial deduction using a complicated system that takes into account the type of business involved, property owned by the business and total wages paid to employees.

The post Deduct These Work Expenses on Your Tax Return This Year first appeared on Joggingvideo.com.

]]>The post New Emoji Candidates Up for Approval Soon: Jellyfish, Goose, Turquoise Heart and More first appeared on Joggingvideo.com.

]]>

A goose, moose, jellyfish, turquoise heart, head shake and pair of maracas are among the new emoji that could be on their way to your phone. The Emoji 15.0 update includes all those candidates and more, and it could be hitting devices as soon as this fall.

Earlier this summer, emoji reference website Emojipedia published sample designs for each emoji candidate that Unicode, the global standard for messaging, could approve for widespread use in September. (Here’s what they look like.)

Not all the candidates are guaranteed to be approved by Unicode. If they are, they may have a slightly different look once Apple and Google add them to their platforms, Emojipedia’s Keith Broni wrote in a blog post. Most of the emoji candidates in recent years have made the final update lists, Broni added.

Read more: Emoji: How to Decipher and Understand Them

Once Unicode finalizes the list in September, it may still take a while for the new emoji to be rolled out to devices. Emojipedia released a tentative schedule for the rollout:

- September: The final version of Emoji could be released.

- October to December: Google and Android could start supporting the new emoji.

- January to October 2023: The majority of platforms will add support for the emoji, including Twitter, Facebook, Apple and Samsung.

For more on upcoming tech releases, here are the new iPhone features included in the iOS 16 beta and here’s what to know about the new Android 13 operating system. Plus, here’s how iOS 16 and Android 13 could change the future of smartphones.

The post New Emoji Candidates Up for Approval Soon: Jellyfish, Goose, Turquoise Heart and More first appeared on Joggingvideo.com.

]]>The post Intel Warns That Price Hikes Are Coming This Year first appeared on Joggingvideo.com.

]]>

The cost of Intel’s Wi-Fi chips is going up this year. The semiconductor company will raise prices on its microprocessors and peripheral chip products later this year, Nikkei Asia reported on Thursday.

Intel’s processors are found in Dell, Lenovo, HP and other computers, meaning those devices will become more expensive to produce.

Due to the rising costs for production and materials caused by inflation, Intel will raise prices on its central processing units for computers and servers. Other flagship products, like chips for Wi-Fi and other connectivity tech will also see a price hike. The company has started informing customers of these changes, Intel spokesperson William Moss said in a statement emailed to CNET.

The percentage increase will likely vary depending on the chip in question, but products could see single-digit or double-digit increases, Nikkei Asia reported.

The news comes amid surging inflation across the country and worries about a possible recession. Inflation broke a US record with a 9.1% increase in consumer prices in June.

The post Intel Warns That Price Hikes Are Coming This Year first appeared on Joggingvideo.com.

]]>The post Step Aside, Hulu Live and Sling TV: YouTube TV Blasts Past 5 Million Subscribers first appeared on Joggingvideo.com.

]]>

YouTube TV is leading in the live TV streaming market. The platform announced on Tuesday that it eclipsed 5 million subscribers, including paying members and free trials.

YouTube TV’s number of subscribers beats the 4.1 million subscribers of rival Hulu Live as of April 2. Other competitors include Dish Network-owned Sling TV, which was at 2.25 million members at the end of March, and FuboTV, which has around 1.06 million subscribers.

The live-television streaming market surged about eight years ago, but has since struggled with sluggish growth. Live-channel services like YouTube TV were once seen as the natural successor to expensive cable and satellite subscriptions for cord-cutters. But TV customers have instead gravitated to cheaper, on-demand streaming services like Netflix, Disney Plus and HBO Max, while most live-channel services have only grown more expensive.

Read more: Best Live TV Streaming Service for Cord-Cutters in 2022

YouTube, which is owned by Google, launched its live TV platform five years ago, and it’s now available with 100-plus channels, unlimited cloud DVR space, Spanish language content and a family plan. Prices start at $65 per month, with $10 off for your first three months.

YouTube TV is CNET’s Editors’ Choice for best premium live TV streaming service. In his YouTube TV review, Ty Pendlebury says, “While it has almost doubled in price since [launch], it continues to be a better choice than any of its premium competitors.”

Along with the 5 million subscriber announcement came a Top 5 list of the most DVR’d shows on the platform:

- Yellowstone

- Saturday Night Live

- This Is Us

- 60 Minutes

- Grey’s Anatomy

The announcement also included a Top 5 of the series “viewers are nostalgic for”:

- Friends

- The Office

- Two and a Half Men

- Big Bang Theory

- Everybody Loves Raymond

For tips on which live TV streaming service is right for you, here’s a comparison of YouTube TV and Sling TV.

The post Step Aside, Hulu Live and Sling TV: YouTube TV Blasts Past 5 Million Subscribers first appeared on Joggingvideo.com.

]]>The post Meta AI Tool ‘Sphere’ Could Help Curb Fake News first appeared on Joggingvideo.com.

]]>

Facebook parent company Meta on Monday launched Sphere, an AI information verifier that validates the strength of claims in web entries, as reported earlier by TechCrunch.

The tech news outlet provided a demo showing how the software could work on Wikipedia. In a video, Sphere scans citations and then displays whether the information failed or passed verification. Though Wikipedia is interested in the research, it is not used in production by the company, a Meta spokesperson told CNET via email.

Meta has fared poorly with the volumes of false information on its sites. In June, the company began to crack down on fake reviews on Facebook. Meta also has plans to scrap CrowdTangle, the tool it uses to monitor misinformation on its platforms, after the midterm elections in November.

Sphere is still in its research phase and Meta has no plan at this time to use it on its platforms, according to a Meta spokesperson.

Correction: An earlier version of this story misstated the scope of Sphere’s use. Meta says the AI tool is still in research and not yet in production.

The post Meta AI Tool ‘Sphere’ Could Help Curb Fake News first appeared on Joggingvideo.com.

]]>The post WhatsApp Expands Emoji Reactions for Further Messaging Expressiveness first appeared on Joggingvideo.com.

]]>

People can respond to a WhatsApp message with any emoji under the sun thanks to a new update, Meta CEO Mark Zuckerberg said in a Facebook post on Monday. The update will start rolling out shortly, and should be available to all WhatsApp users in the next few weeks.

To use the newest feature, continuously press on the message you’d like to react to until the emoji bar pops up. The bar will include a plus sign, allowing people to go beyond the standard six emoji and react with whichever one they desire.

WhatsApp announced updates to the app, like Communities and emoji reactions, in April in response to messaging app competitors like Telegram.

Facebook, which last year rebranded itself as Meta, bought WhatsApp in 2014. Meta didn’t immediately respond to a request for further comment.

The post WhatsApp Expands Emoji Reactions for Further Messaging Expressiveness first appeared on Joggingvideo.com.

]]>The post Samsung, Starbucks Collab on Coffee first appeared on Joggingvideo.com.

]]>

Samsung and Starbucks are making coffee-themed Galaxy S22 accessories and a Galaxy Buds 2 case, all of which sport a combination of the Starbucks logo with various shades of green to match. They’re available for purchase Tuesday, but only in South Korea for now.

The Starbucks line includes the entire Galaxy S22 line, with cases also available for the S22 Plus and S22 Ultra. The buzzworthy case lineup takes inspiration from the coffee chain — from the signature Starbucks green aprons to the latte art in your favorite cup of joe. There’s even a phone case that looks like a Starbucks receipt.

The two new Galaxy Buds cases include a forest green case flashing the Starbucks logo and a case that resembles a mug with a latte art heart inside of it. The cases are compatible with Galaxy Buds 2, Galaxy Buds Pro and Galaxy Buds Live.

This Starbucks collaboration isn’t the first whimsical phone accessory collab Samsung has participated in. For Samsung’s Galaxy Z Flip 3 in April, the company partnered with Pokemon to create Pikachu and Poke ball merch.

See Also: Best Samsung Phone for 2022

Now playing:

Watch this:

Samsung’s Cheapest Galaxy Phones Reviewed: What $180…

6:50

The post Samsung, Starbucks Collab on Coffee first appeared on Joggingvideo.com.

]]>The post iOS 16 Offers Editable Messages, but They Might Not Be Compatible With Older Phones first appeared on Joggingvideo.com.

]]>

When Apple announced iOS 16 earlier this month, the ability to edit iMessages was among the software update’s most attractive new features. However, it doesn’t show up quite so cleanly on devices that haven’t updated to iOS 16, 9to5Mac reported.

If an iOS 16 user sends a message and then edits it, devices running iOS 15 will receive the unedited message followed up by a text that includes “Edited to” with the edited message.

Apple hasn’t figured out how to delete or unsend these messages yet, according to 9to5Mac.

iOS 16 is still in development and has not been rolled out to the public, with a general release of the software update likely to come in September. Along with the ability to edit iMessages, people can expect a redesigned lock screen and improvements to Apple Maps. While the software isn’t publicly available, people can download the developer beta now.

Apple didn’t immediately respond to a request for comment.

The post iOS 16 Offers Editable Messages, but They Might Not Be Compatible With Older Phones first appeared on Joggingvideo.com.

]]>The post Uber Revives Shared Rides With UberX Share in New York, Los Angeles, Chicago first appeared on Joggingvideo.com.

]]>

For people using Uber in some major US cities, their next ride might be one they take with strangers.

The ride-hailing giant on Tuesday said it’s expanding its new ride-sharing program, UberX Share. The new feature, which pairs riders heading in similar routes, is now available in New York City, Los Angeles, Chicago, San Francisco, Phoenix, San Diego, Portland-Oregon, Indianapolis and Pittsburgh. UberX Share will expand across more cities this summer, according to a blog post from Uber.

When people choose to share their ride through UberX Share, they’ll receive an upfront discount along with 20% off the total fare if they are matched with another rider.

To avoid prolonged rides and delays, UberX Share will match riders going in the same direction. The new feature is designed with punctuation in mind: Uber said riders who use the sharing feature will arrive no more than eight minutes later than an UberX ride.

“This new shared rides offering will provide a more affordable, efficient and sustainable experience for riders, drivers, the cities we serve, and for Uber,” Andrew Macdonald, senior vice president of mobility at Uber, said in the blog post.

During the beginning of the pandemic, Uber suspended its ride-sharing feature, Uber Pool. It instituted UberX Share as a pilot program in Miami in November to combat rising ride costs.

The return of the ride sharing option comes amid country-wide gas price increases, as well as Uber’s expanded sustainability initiatives. Uber aims to become a zero-emission platform by 2040 and, by 2030, have all of its rides in the US, Canadian and European cities take place in electric vehicles.

The post Uber Revives Shared Rides With UberX Share in New York, Los Angeles, Chicago first appeared on Joggingvideo.com.

]]>